The Death of the Pension Fund

Published on July 12, 2016

The Urgent Need for a New Retirement Strategy (Hint: It’s Self-Directed)

Many economists acknowledge and write about the problem of Americans’ lack of preparation for retirement. We don’t save enough—many have virtually nothing set aside for their post-employment years.

Many economists acknowledge and write about the problem of Americans’ lack of preparation for retirement. We don’t save enough—many have virtually nothing set aside for their post-employment years.

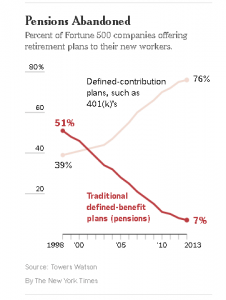

One issue that has contributed to this, according to Wall Street executive Steve Rattner, is that pension plans—the defined benefit plans that were so popular at one time as a perquisite—are disappearing. Just as the Social Security Trust Fund is becoming unsustainable, and not a given for retirees in the foreseeable future, pension funds have also become unsustainable for employers faced with mounting costs and increased regulatory burdens. Taking their place were defined contribution plans such as 401(k)s.

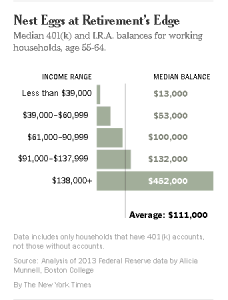

The problem is, Rattner reports that only about 10 percent of participants in these plans actually contribute the maximum amount allowable … so those folks are falling behind on their retirement savings. The move to defined contribution plans has placed a bit of a burden on participants, who must become more knowledgeable about their investment options (typically stocks, bonds, and mutual funds). Depending on the plan offered by the employer, account holders are expected to allocate their assets, evaluate mutual funds, and select individual stocks.

The problem is, Rattner reports that only about 10 percent of participants in these plans actually contribute the maximum amount allowable … so those folks are falling behind on their retirement savings. The move to defined contribution plans has placed a bit of a burden on participants, who must become more knowledgeable about their investment options (typically stocks, bonds, and mutual funds). Depending on the plan offered by the employer, account holders are expected to allocate their assets, evaluate mutual funds, and select individual stocks.

Of course, we all know how things go when people rely strictly on the stock market—just look at the history of stock averages over the past 15 years! (Buckle up kids, it’s a bumpy ride.) Rattner cites these statistics: “In the first quarter of 2016, domestic mutual funds—a favorite investment vehicle for these retirement accounts despite their chronic underperformance—had their poorest showing in nearly two decades. Through June 15, the 20 most popular funds for 401(k) assets were up 0.6 percent so far in 2016, compared with 2.4 percent for the Standard & Poor’s index.”

The author goes on to talk about revamping the 401(k)s but at Next Generation Trust Services, we have a better idea: open a self-directed retirement plan and take control of your future.

Now, we know that self-direction is not for everyone—but it is a great strategy for savvy investors who really understand the many investment options available on the market, from the traditional to the broad array of alternative assets these plans allow. Sick of the stock market roller coaster? Consider including commodities in your self-directed retirement plan. Don’t like how T-bills are performing these days? What about including real estate in your self-directed IRA? The possibilities are numerous.

Now, we know that self-direction is not for everyone—but it is a great strategy for savvy investors who really understand the many investment options available on the market, from the traditional to the broad array of alternative assets these plans allow. Sick of the stock market roller coaster? Consider including commodities in your self-directed retirement plan. Don’t like how T-bills are performing these days? What about including real estate in your self-directed IRA? The possibilities are numerous.

If you are already investing in alternative assets outside of your existing retirement plan, you could be building tax-advantaged retirement wealth through self-direction, with nontraditional investments that aren’t allowed in typical plans. If you are someone comfortable doing the research required to make these investments wisely, and are comfortable making your own investment decisions, we say “go for it!”

So, rather than relying on those stock-based or mutual-fund-dependent 401(k) plans from an employer, find out more about self-directed retirement plans—perhaps you can even self-direct your employer-based plan. It’s worth asking.

At Next Generation Trust Services, we’re committed to helping more people self-direct their retirement plans by providing information and education about how self-direction works, as well as what you may include (and what you may not). Our team of professionals is available to answer your questions or help you get started; you can contact us at Info@NextGenerationTrust.com or 888.857.8058. If you’re a true self-starter, go to our Starter Kits to get your self-directed retirement account open.